Treasury management for startups, made easy

Put your startup cash on autopilot. Maximise your runway with smart deposits and withdrawals from your account, safeguarded and administered by regulated brokers.

Get more from your idle cash, from investments to insights

As a founder, building your business takes priority. Traditional banking products take time away from founders on actually building their businesses. Bad UX, high minimums and manual processes are preventing founders from the potential of earning tens or hundreds of thousands of returns on their idle GBP, EUR and USD.

We're changing that.

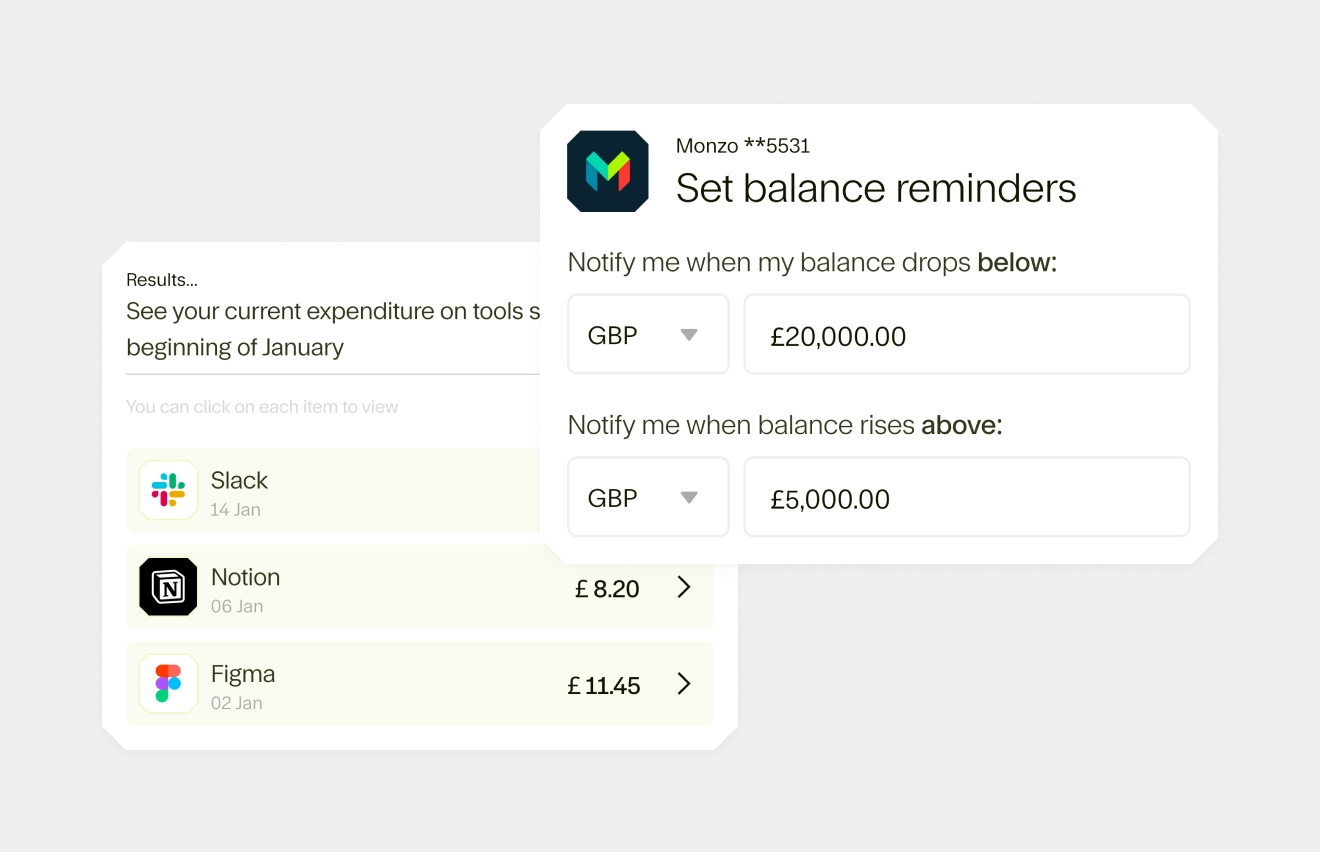

Connect banks and set Balance Reminders

Connect your bank accounts and set the minimum and maximum balance you need to have peace of mind you won't miss a payment.

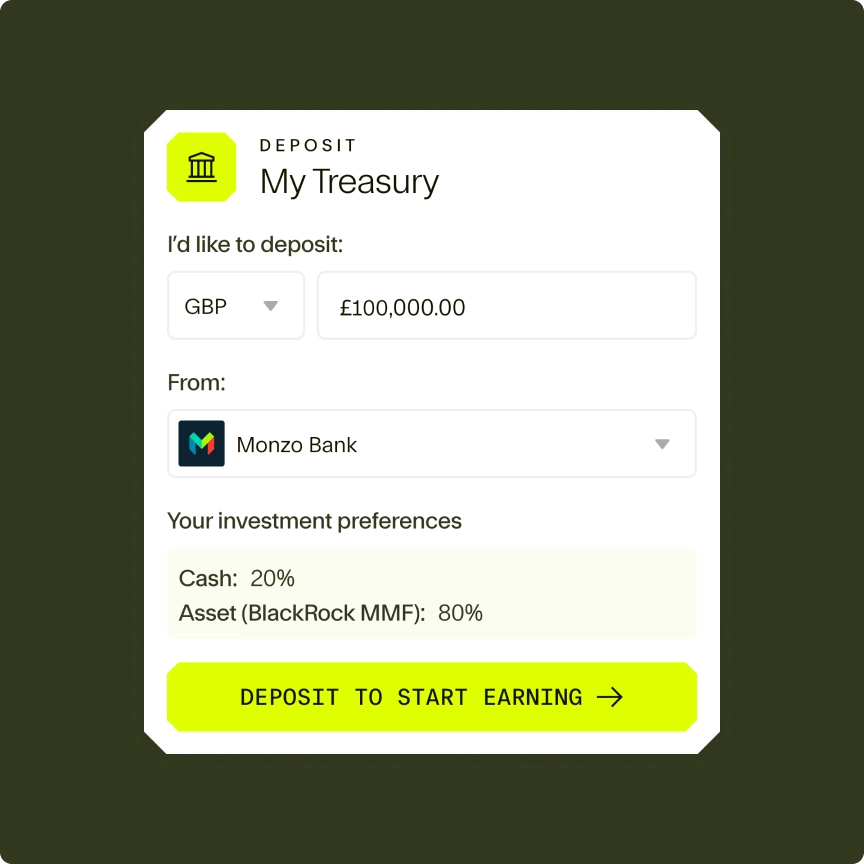

Set up and sit back

Start earning up to 5%*. Set your investment preferences and your cash is invested into Money Market Funds, maximising your liquidity and yield.

Watch your runway grow

Move money between your Treasury and accounts at the click of a button. Enjoy same and next day liquidity so you always have cash when you need it.

Stay in control of your treasury, with minimal effort

Founders have a lot to do, so we’ve built Round to help save you hours (or even days) on managing your business’ finances. All it takes is a few minutes to get set up.

Easily put your idle cash to work and earn up to 5%*, no minimums or lockups

We’ve done the heavy lifting to make it easy for you to access higher interest rates through money market funds managed at HSBC and Blackrock.

Increase your idle cash’s earning power so you can extend your runway, hire the talent you need, and invest in the tools that will save you time.

Withdraw your cash to the right account, at the right time

Making sure you have enough money in your account to pay your bills or make payroll can be stressful. We remove the manual processes of checking your balances and planning for withdrawals, all while maximising the interest you earn on your cash.

We’re able to predict your cash needs ahead of time so you're able to rest easy. We'll make sure you have the right amount of cash, in the right account, at the right time.

Get out of your spreadsheets

Save yourself time managing your finances. Round gives you a consolidated 360 view of your treasury across all your different bank accounts so you can make informed decisions faster. Have all your balances and transactions right at your fingertips.

See how Round could accelerate your business

Based on a fixed 12 month period with a

5.2%* APY

Out-of-the-box treasury management for tech companies, point and go

Goodbye, savings accounts. So long, spreadsheets. Round lets you manage your startup’s cash effortlessly.

Automate

Get peace of mind with automated cash management. See where your business is running low on cash, and get notified when your balances change so you never miss critical payments. Effortlessly withdraw, based on your preferences, to give you back time and peace of mind.

Access

It’s your cash — use it when you need it. Access your funds fast with same or next-day withdrawals to keep your cash flowing smoothly.

Analyze

When you have questions, we have answers. Round’s platform connects with your Xero and aggregates your bank accounts with Open Banking to provide you with simplified reporting and insights so you can share what matters most with the least effort.

We’ll help you stay protected

Your money matters. Here’s how we ensure it is safe.

Security

Both Round and the broker take security and protections of our user data very seriously. These measures include using secure protocols for data transmission, encrypting sensitive information and implementing two-factor authentication.

Investment Safety

A money market fund is a low-risk investment that aims to give you a slightly higher return than a savings account. Money Market Funds invest in ultra-short-term debt (1-7 days) from the government or central banks and critical financial institutions.

Segregation

Your brokerage account is in your name, and your assets are fully segregated from ours and other clients. Round or any third-party is not in the flow of funds.

Have some questions?

You'll need to be a UK entity and provide basic company information as well as the company's beneficial owners (with >25% ownership).

We use Interactive Broker as our prime brokerage and assist you in opening an account. Because the account is in your name, your assets are fully segregated which means they can be returned to you in the unlikely event of a default or bankruptcy of Round or its investment manager.

Money market funds consist of government backed securities such as bonds, notes and bills. The default risk on these instruments in the government collapsing and are typically considered safer than holding your money at a bank.

BlackRock Money Market Funds are custodied with JP Morgan in your name. This means the assets of the funds are separate and segregated from the assets of BlackRock or Interactive Brokers. In the event that BlackRock or Interactive Brokers is financially compromised, the assets would not be affected by any debts that BlackRock or Interactive Broker might have. In certain unlikely events, daily liquidity is not guaranteed.

Can’t find the answer you’re looking for? Feel free to get in touch with us.